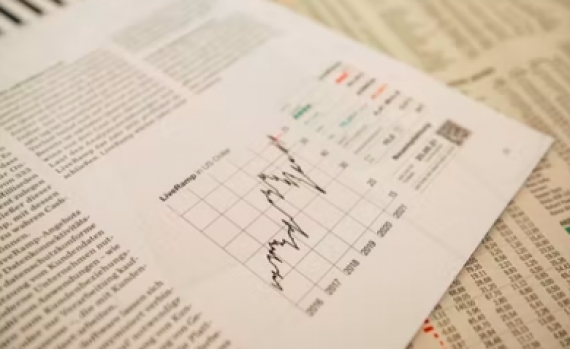

Last week, the Federal Reserve raised interest rates by 75 basis points, the largest increase since 1994. The Fed is taking an aggressive approach to combat rising inflation triggered by pandemic-related supply chain constraints and the war in Ukraine. Consumer prices rose in May at the fastest pace in over 40 years. With more rate increases expected, investors and advisors alike have reason to be concerned about both stock and bond returns in the near term. Bond prices fall as rates go up. In response to that uncertainty, advisors could consider an active bond strategy that adapts to changing interest rates and credit spreads. One way to do that is through a short-term variable income strategy. This can be achieved through the FlexShares Ready Access Variable Income Fund (RAVI), a short-term actively managed ETF. The managers of the fund attempt to identify the highest return potential securities based on macro analysis, credit research, and risk management.

Finsum: In response to persistently high inflation, the Fed is aggressively raising interest rates, which is why advisors should consider a short-term active bond strategy to navigate the current market.

Stay informed with our newsletter and get the latest news, updates, and exclusive offers delivered to your inbox. Join our community!